Free zones in Dubai The time period that an investor or businessman needs to establish his company in a free zone ranges between one and two months, and the possibility of accelerating this process depends on the speed of providing the required papers and documents as well as the payment of fees and costs by the owner or investor.

The Jebel Ali area in Dubai is one of the largest economic areas in the Middle East, as it contains one of the largest international ports, “Jebel Ali Port, which plays a vital role in serving global markets, and plays a pivotal role in the economy of the United Arab Emirates.” Through our article, we will learn many details about establishing companies in free zones .

Activities that foreigners are allowed to practice in the Emirates

In the Emirates, there are laws and legislation that specify the commercial activities that foreigners can practice alone or in cooperation with Emirati partners. Activities are usually divided into several categories that include:

- Exclusive activities for Emirati citizens: Requires 100% Emirati citizen participation, such as agriculture, fishing, and some real estate services.

- Activities with a specific legal percentage: require the participation of an Emirati citizen in a certain percentage, such as construction, engineering, and retail.

- Activities open to foreign investors: Foreigners can practice these activities without the need for a partnership with an Emirati citizen, such as consulting, technology, financial services, and general trade.

- Prohibited activities: These include some activities that foreigners are not permitted to engage in due to security or strategic reasons, such as national security and military services.

To obtain an updated and comprehensive list of activities permitted for foreigners in the Emirates, you can view the website of the Department of Economic Development in each emirate or consult the experts of Itqan Company in establishing companies in Dubai.

The cost of establishing companies in free zones in Dubai

The cost of setting up a company in Dubai free zones may vary widely based on several factors such as the type of company, the size of the planned business activity, and the specific free zone. Here are some general points that affect the financial cost:

- Registration fees: Includes company registration fees, which vary according to the type of company and the chosen activity.

- Contract and rental costs: You may need to pay a deposit and rent for the office or commercial space within the free zone.

- Government fees: Some free zones may impose additional fees on companies.

- Licenses and Permits: You may need to pay fees to obtain the necessary licenses and permits to start the business.

- Additional services: such as legal and advisory services that you may need to facilitate the company establishment process.

To obtain an accurate cost, it is recommended to contact the relevant free zone in Dubai or deal with authorized service providers who can provide detailed estimates that suit your company’s specific needs and requirements.

Commercial license in Dubai

A business license in Dubai is a type of business license that enables business owners to start a business quickly without having to wait long periods for approval. Here are some key points about instant license in Dubai:

- Companies can obtain an instant license quickly without the need for lengthy approval procedures.

- The instant license includes a variety of business activities such as consulting, general trading, logistics, etc., but this varies according to current legislation.

- General conditions for obtaining an instant license include having a commercial office or rented space, and submitting some basic documents such as a passport and a personal photo.

- You may enjoy additional advantages such as not requiring large capital and the possibility of quick renewal of the license.

For accurate information on how to obtain an instant license and the exact conditions, it is recommended to contact Itqan Company in Dubai.

Documents required to establish a company in the free zone

Establishing a company in a free zone in the Emirates requires submitting a set of documents and basic documents. The required documents are usually as follows:

- Registration Application Form: The registration application form must be filled out with the basic information of the company.

- Copy of passport for foreign shareholders: Certified copies of passports must be submitted for all foreign shareholders.

- Personal photos of major shareholders: Personal photos of all major shareholders in the company.

- No-objection certificate: If the company is operating under the authority of another company or with the approval of one of the relevant authorities, it may need a no-objection certificate.

- Simple business plan: A brief breakdown of the company’s planned goals and activities.

- Office Lease Agreement or Certificate of Title: A copy of the office lease agreement or certificate of ownership for the location where the company’s operations will be conducted must be submitted.

- Bank letter: It requires a letter from the bank proving the existence of a bank account in the name of the company to be established.

- Other government approvals: Some free zones may require additional government approvals depending on the type of activity and location.

You must ensure that all required documents are provided according to the chosen free zone, as requirements may vary based on the type, geographical location and the emirate’s legislation. It is recommended to engage with professional service providers to assist in preparing and submitting documents correctly and in a timely manner.

Conditions for an instant license in Dubai

The conditions for obtaining an instant license in Dubai vary depending on the type of business activity, but in general, here are some general conditions that may include:

- Geographical Location: You must have an office or rented commercial space in an approved area in Dubai.

- Required capital: Some activities may require a certain capital to obtain a license.

- Required documents: Submit documents such as a passport, personal photo, rental contract, and sometimes a simple business plan.

- Special licenses: For some activities such as medicine or engineering, you may need a special license.

- Government fees: Payment of registration fees and government fees related to the license.

For accurate and up-to-date information, you can visit the Dubai Department of Economic Development website or contact one of the service providers to assist in preparing and submitting an instant license application based on your specific business activity.

Establishing a company for foreigners in the Emirates

A company can be established for foreigners in the UAE through several options, according to local laws and legislation. Popular options are to create a limited liability company (LLC) or create a branch of a foreign company. Here is an overview of the basic steps to establish a foreign company in the UAE:

- Research and study: Conduct the necessary research to understand the local market and legislation related to the establishment of foreign companies in the Emirates. You can consult a legal advisor or consulting firm for assistance in this process.

- Choosing the legal type of company: Decide what legal type you would like to establish, whether it is a limited liability company (LLC) or a branch of a foreign company.

- Obtain an establishment license: You may need to obtain an establishment license from the relevant government agencies. You can contact the National Economic Development Authority, the Federal Authority for Identity and Citizenship, or the local Economic Affairs Authority in the emirate where you intend to establish the company to obtain more information and procedure guidance.

- Choosing a name and submitting documents: Select the company name and submit the required documents, such as completed forms, required signatures, and other supporting documents.

- Partnership Agreement: If you intend to establish a limited liability company (LLC), you must enter into a partnership agreement with a local partner who owns a share of at least 51% of the capital. You can regulate the partnership relationship through a written partnership agreement in accordance with local laws.

- Work license: After completing the previous procedures, you may need to obtain a work license from the relevant authorities, such as the Ministry of Human Resources and Emiratisation. This requires submitting the required documents and adhering to legal requirements.

In conclusion of an article about establishing a company in the Dubai Free Zone , it can be said that taking advantage of this opportunity is a strong investment opportunity in the international business market. Thanks to government facilities, advanced infrastructure, and a supportive business environment, Dubai is an ideal destination for investors wishing to establish their companies in the Middle East. Dubai’s free zones provide expatriate companies with diverse and unique possibilities for growth and expansion, whether in logistics, technology, financial services, or other sectors. Therefore, investing time and effort in setting up a company in a Dubai free zone is a wise strategic move that ensures access to new markets and sustainable business growth.

Frequently asked questions about establishing a company in the Dubai Free Zone

What are the main advantages of setting up a company in Dubai Free Zone?

Dubai free zones enjoy many advantages such as exemption from taxes on profits, 100% ownership by foreign investors, easy access to the regional and international market, and advanced infrastructure.

What types of companies can be established in the Dubai Free Zone?

A variety of companies can be established in Dubai’s free zones, such as limited liability companies, sole proprietorships, and personal companies.

What are the basic steps to establish a company in Dubai Free Zone?

The basic steps include: choosing the appropriate free zone, submitting the required documents such as the registration application form and a copy of the passport, signing the lease contract or ownership certificate, and paying the required fees.

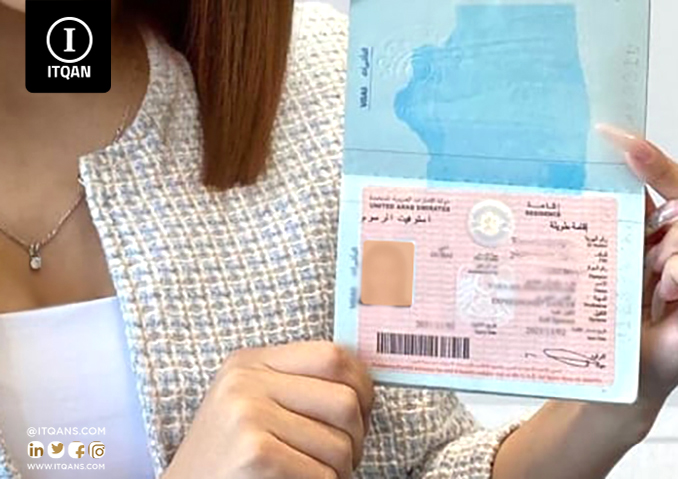

Can foreigners obtain a residence visa to establish a company in the Dubai Free Zone? Can foreigners obtain a residence visa to establish a company in the Dubai Free Zone?

Yes, investors and employees of the company can obtain a residence visa for a certain period that depends on the type of company and the requirements of the free zone.